Maximising Marketing ROI: Aligning Spend with Customer Acquisition Cost and Lifetime Value

- Carl Partridge

- Jan 17, 2025

- 2 min read

In today’s competitive landscape, businesses must strategically allocate marketing budgets to achieve sustainable growth. Understanding Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLTV) is essential, particularly for membership-based models.

Organisations can optimise their marketing investment by aligning these metrics to attract and retain members effectively.

What Are CAC and CLTV?

Customer Acquisition Cost (CAC): The total cost of acquiring a new customer, including marketing, sales, and associated overheads. Formula:

Customer Lifetime Value (CLTV): The total revenue a customer generates over their relationship with your business. Formula:

For membership organisations, these metrics are vital for determining how much can be spent on acquiring and retaining members while maintaining profitability.

Aligning Marketing Spend with CAC and CLTV

The golden rule is that CLTV should significantly exceed CAC. A high CLTV-to-CAC ratio—ideally above 3:1—indicates an efficient and sustainable customer acquisition strategy. Conversely, if CAC is too high relative to CLTV, it suggests inefficiencies in acquisition or retention strategies.

Calculating and Optimising Marketing Spend for Membership Models

Let’s use an example to illustrate. Imagine you manage a membership organisation with the following data:

Membership Fee: $120 per year

Average Member Retention: 5 years

Profit Margin: 50% (after operational costs)

Marketing Spend: $30,000

New Members Acquired: 150

1. Calculate CAC

2. Calculate CLTV

3. Assess ROI

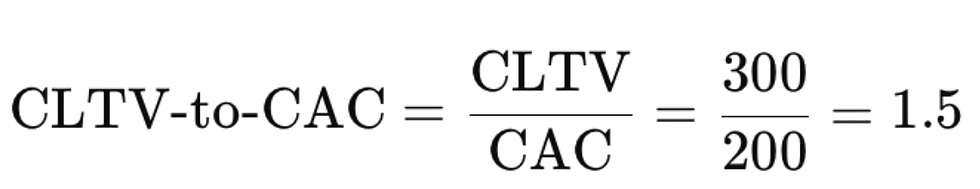

With a CLTV of $300 and a CAC of $200, the CLTV-to-CAC ratio is:

This ratio is below the ideal benchmark of 3:1, indicating that the current marketing strategy isn’t sustainable.

4. Optimisation Strategies

Enhance Retention: Increase the average member retention from 5 to 7 years. New CLTV = $120 × 7 × 0.5 = $420 Revised Ratio = $420 / $200 = 2.1

Lower Acquisition Costs: Use targeted digital campaigns to reduce CAC to $150. Revised Ratio = $300 / $150 = 2.0

Increase Membership Fees: Introduce tiered membership plans or additional benefits to raise fees to $150. Revised CLTV = $150 × 5 × 0.5 = $375 New Ratio = $375 / $200 = 1.875

A combination of these strategies can steadily improve marketing ROI.

Key Takeaways for Membership Models

Understand Your Metrics: Regularly calculate CAC and CLTV to track performance and profitability.

Segment Your Memberships: Identify and target high-value members to optimise acquisition efforts.

Focus on Retention: Retaining members is often more cost-effective than acquiring new ones. Implement loyalty programs, personalised communication, and exclusive content to boost retention.

Refine Marketing Strategies: Use data-driven insights to focus on channels with the best ROI.

Conclusion

Aligning marketing spend with CAC and CLTV isn’t just about numbers—it’s about creating a sustainable and efficient strategy for growth. Membership-based businesses, particularly, rely heavily on balancing these metrics to ensure long-term success. By focusing on retention, optimising acquisition costs, and increasing member value, organisations can achieve strong ROI while building a loyal and engaged membership base.

Comments